You don’t need anyone to tell you that the last few years have been challenging ones for businesses. There have been ongoing effects from the COVID-19 crisis, rising inflation, armed conflict in Eastern Europe, and other difficulties in the U.S. and abroad.

As 2023 unfolds, it’s clear we’re in for another chaotic year. Businesses will have to contend with many of the same issues and several new ones. As a result, it’s imperative that business owners and operators prepare for potential difficulties.

One way to do that is to have adequate business insurance. While financial protection can’t prevent lawsuits, property damage, etc., proper coverage makes it much easier to recover from them.

Why Is Business Insurance Crucial to Business Success?

If your business has never been hit with a large, unexpected expense, you might question whether you really need business insurance coverage. After all, why pay for something you aren’t using?

Unfortunately, many companies that felt that way and consequently didn’t carry small business insurance are no longer in business today. Why is that? They had to close their doors permanently because of the overwhelming financial burden caused by an incident (or multiple incidents) not covered by insurance.

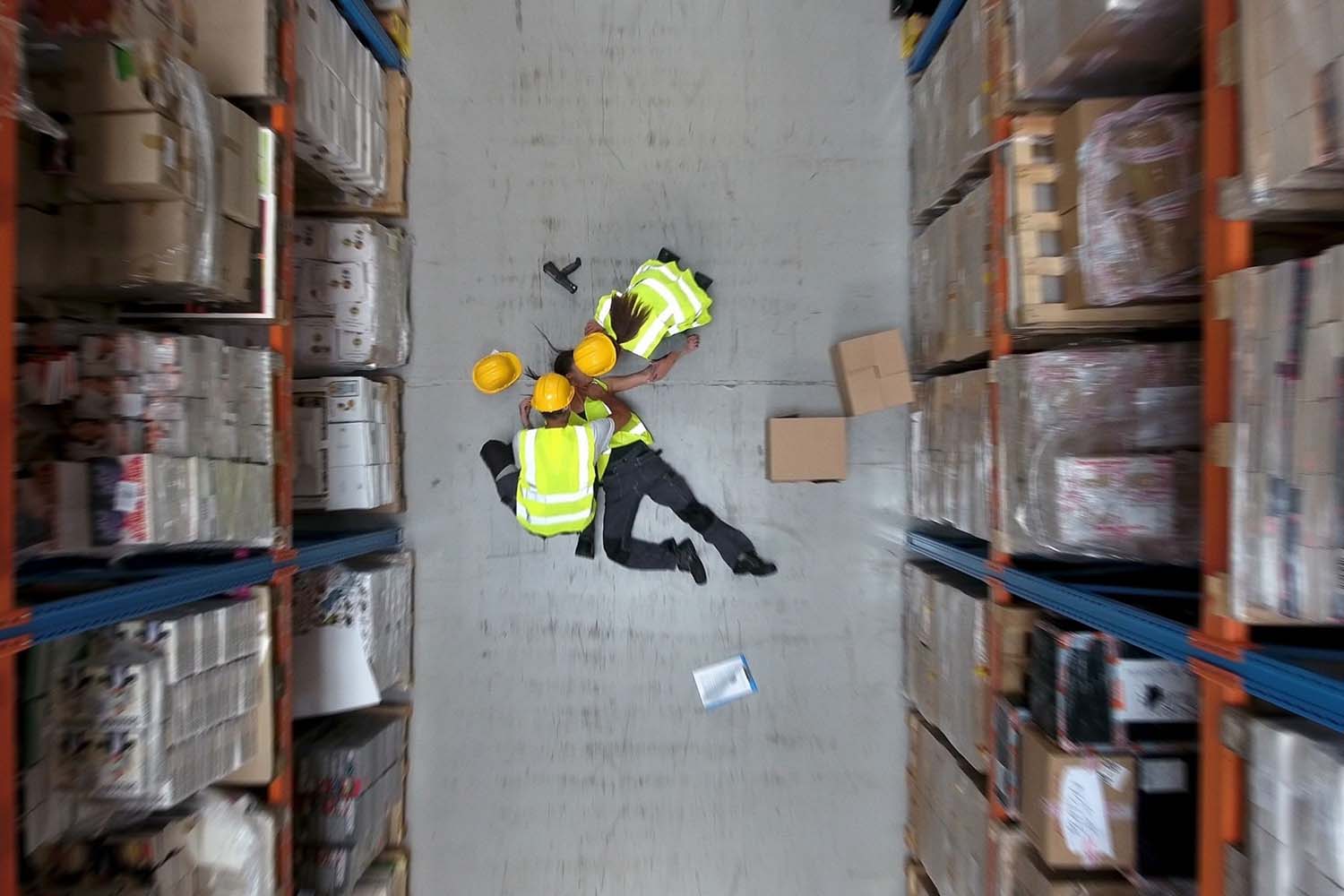

The reality is that the costs associated with even one adverse event can rock a company’s financial stability. For example, imagine that a delivery person is dropping off a package when they slip on a wet floor at your place of business, fall, and break their wrist. That type of accident surely happens nearly every day somewhere in America. And if that person sues your company, it can be costly.

Even before a court judgment is reached, you must pay for your legal defence. Then, if the court finds in the plaintiff’s favour, you’ll have an even larger expense. It’s not uncommon for a minor injury to result in costs running into the five- or six-figure range (or more!), and if you don’t have insurance, your company will be responsible for paying the bill.

Keep in mind that the fact your company hasn’t been sued recently or ever doesn’t mean it won’t be sued. The next person to walk through your door could trip over a rug or a damaged section of carpet and find themself in an urgent care centre or emergency room. And that’s just one of many reasons your company could be hit with a lawsuit. There are countless other risks your business faces.

The good news is that there are small business insurance policies designed to address virtually every type of liability or loss.

Small Business Insurance: What To Expect in the Year Ahead and Beyond

Business owners who stop to consider the very real possibility of being sued, suffering property damage, etc., quickly become interested in business insurance. And after learning a little bit about the different types of coverage available, they typically start to wonder about the industry more broadly, how it may be evolving, and how the changes will affect them.

If that describes you, here are three crucial business insurance trends to be aware of this year:

1 – Buying business insurance will continue to get easier

A trend over the last decade that will continue this year is the transition of insurance transactions from in-person to online. Insurers increasingly understand that business owners and decision-makers don’t have time to visit physical offices. Consequently, those companies are always striving to make it easier for businesses to get instant quotes, buy coverage, report claims, and manage their policies online. Those capabilities aren’t new, but transactions continue to get more efficient.

Online access to insurance policies and information for understanding them is essential for busy professionals. You can start by doing a little research whenever you have time—early in the morning, at lunchtime, in the evening, etc.—to learn about the most commonly needed coverages. Every business owner should understand what workers’ compensation, general liability, professional liability, commercial auto, cyber, and umbrella insurance policies are.

Then, if you decide to purchase policies, you can also do that online. Coverage is typically active in the next day or two, and if you need to report a claim, you can do that on your insurer’s website, as well. Managing your policies (reviewing your coverage, updating your company’s profile, etc.) is also an online activity.

2 – There will be clearer distinctions between insurance providers

If there’s anything positive about the ups and downs of the last few years, it’s that they’ve created a clear separation between business contenders and pretenders. That means it’s easier to find an experienced, trustworthy insurer that you know will be there for you when you file a claim.

Newer insurance companies aren’t “bad,” per se, but they may not have the experience or financial resources you’d expect from a business tasked with protecting your company’s financial future. Consequently, going with them can be a gamble.

3 – Business owners who buy online will pay less for insurance

Purchasing policies online from a reputable insurance company can deliver big savings. By cutting out brokers and others “in the middle,” they can often sell insurance for 20% less than other providers.

So, while small business insurance is a valuable asset and well worth the investment, there’s no reason to pay more than necessary for your coverage. And you can use every penny you save to fund things like more marketing, research and development, etc. Or you can let the savings go straight to your bottom line.

Small Business Insurance: More Important Than Ever in 2023

The business landscape is continually evolving. But one thing that hasn’t changed is companies that have adequate small business insurance are much better positioned for success than those that don’t.

Even if an incident not covered by insurance doesn’t put you out of business, it can create financial challenges that cause you to lag behind your competitors. And as fast as things move today, losing ground can be an existential threat to your business.

On the flip side, a covered incident can be a minor bump in the road that doesn’t affect your finances or your operations. All things considered, if you don’t have business insurance, getting it today may be the best business decision you’ll make all year!