| Author | Reviewed by ✅ |

|---|---|

| Stephen A. Martin Consumer Finance Contributor, We Heart Stephen A. Martin is a consumer finance expert with extensive experience in personal finance, budgeting, and wealth management. He contributes to lifestyle publications, offering practical advice on managing money, saving, and financial planning. Stephen’s approachable style makes complex financial topics easy to understand, helping readers make informed decisions to improve their financial wellbeing. | James Davidson Editor in Chief/Founder, We Heart James Davidson is the Founder and Editor-in-Chief of We Heart, a leading lifestyle platform he has helmed for nearly 17 years. He has collaborated with top brands such as Audi, Veuve Clicquot, Samsung, and Google. Under his guidance, We Heart has grown from a niche magazine to a widely respected authority on all areas of lifestyle. With a background as a freelance travel writer, James brings a wealth of experience to his editorial work. |

| 1 |

|---|

| Financial Disclaimer: The content provided on this site is for informational purposes only and should not be considered professional financial advice. We encourage you to consult with a qualified financial advisor before making any financial decisions. We Heart is not responsible for any financial losses or damages resulting from your reliance on the information provided. |

The sooner you begin, the more time you have to save. So start today. Living a debt-free life is one of many people’s dreams, but most don’t get to achieve it for reasons as simple as not knowing how. In this article, let’s look at verified and straightforward ways of saving, paying off loans and mortgages, and living a debt-free life.

Photo, Daniel Thiele.

Before diving deep into these tell-tale secrets, let’s briefly explain what money management is…

What is Money Management? Money management refers to the process(es) of budgeting money, saving money, investing money, and spending money. It involves monitoring how money is gotten and expended by an individual, company, or government. Money management is critical because it is a determining factor of who stays rich and who becomes poor over time. A common characteristic of today’s billionaires is money management.

Founder of Amazon, Jeff Bezos, said: “I think frugality drives innovation, just like other constraints do. One of the only ways to get out of a tight box is to invent your way out.” [1]

Wang Jianlin, the founder of China’s largest Real Estate development company, Dalian Wanda Group, said: “I am not a person who pursues luxury. I am not like those people who, once they have money, compulsively squander it or show it off.”[2] Observe the shared belief in ‘frugality’, which is the quality of being economical with money. In other words, effective money management.

How Do I Manage Money?

Everybody needs to manage money. Their opening statement in the article Money Management said: “Whether you have a job, run your own business, or receive an allowance, understanding how to manage your money can help you survive and thrive.” [3] Below are eight expert tips on effectively managing money and staying on top of your monthly expenses…

1. Record All Your Expenses: Start from the root problem. Take a sample month, preferably the recent past month, and highlight the things you spend money on. List out all your expenses. Leave nothing out. Note the seemingly little things like how much you spend on a cup of coffee. Once done, group them into categories, such as groceries, taxes and levies, insurance, and write out the amounts and total for each class. Experts advise using your bank’s statement or credit card transaction history to get the correct prices.

2. Set a Savings Goal: Now that you know where your money goes, it’s time to plan for the money that stays. It’s imperative to note that people save for varying reasons. Whether it’s for a new car, children’s education, or for a holiday, setting a savings goal will help you get there. Find out how much money you need to save and how long it’ll take you to reach the goal.

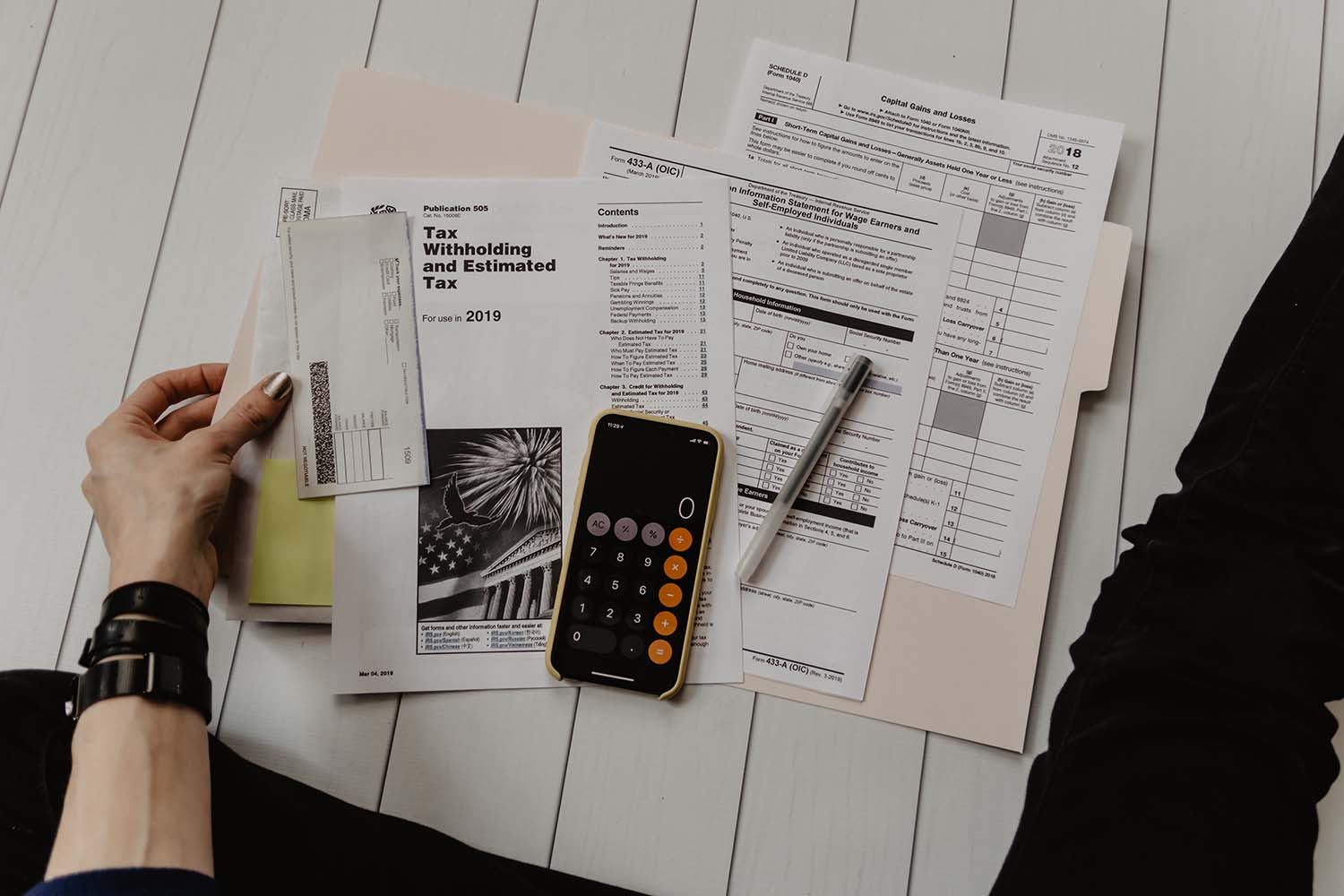

Photo, Kelly Sikkema.

3. Plan Your Budget: Planning your budget typically goes with setting a savings goal. Once you discover how you spend money, you can create a budget that fits your income and spending. This will aid you to not stray. It is recommended that you review your budget occasionally and monitor your progress as you close in on your goals.

Photo, Austin Distel.

4. Prioritise: Ensure that your budget covers the most important aspects of your savings goal. Take long-term expenses into consideration. Examples include Emergency funds, College tuition, Investment funds.

5. Pay Off Debts: Always remember that paying off credit card debts and loans early will save you thousands in interest. Some people use what’s left of their income, after their regular expenses are sorted out, to settle loans and debts. Others include settlement of loans as a significant expense. Whichever works for you, remember that the goal is to be debt-free.

Another significant debt that needs not be overlooked is mortgage loans.

In 2019, the repossession of houses reached an all-time low. It went further to note that the number of homes repossessed in the UK was at the lowest level for the first time since 1980. “There were 4,580 homes repossessed by mortgage lenders from owners who were unable to keep up with repayments on their home loans. Low mortgage rates and a less aggressive attitude from lenders has meant low levels of repossession in recent years.” [4]

Although this is good news, experts still warn of a spike in the rise of repossessions in the near future and that homeowners should not relent or grow complacent in their repayments. Jackie Bennett, director of mortgages at UK Finance, said: “We would always encourage anyone with concerns about making their mortgage repayments to contact their lender to discuss the options and support available to them. Repossession is always a last resort.” [5]

Sometimes, calculating how much of your income should go into your mortgage repayment can be daunting. Many individuals make use of a tool called a mortgage calculator. All you need to do is insert your Home price, Interest rate, Deposit, Mortgage amount, and duration, and it tells you how much you are to pay monthly or yearly as the case may be.

Photo, Justin Lim.

6. Shop the Best Deals: As valuable as credit cards may be, they are a major avenue through which people incur unnecessary and heavy debts. When getting a credit card, ensure you read the fine prints before agreeing to the service terms. If you can, get a lawyer to explain what the contract states. Always look out for cards with fewer fees and have the lowest interest rates; it will save you a lot of money and lead you on the path to a debt-free life.

Similarly, when buying insurance. Whether a car or health insurance, always compare premium amounts and go for the best deals. Do not forget to read through the contract before signing carefully.

7. Save for Retirement: Remember our opening statement in this article, ‘The sooner you begin, the more time you have to save.” The truth remains, you get a head start when you begin to plan for the future from today. It doesn’t matter how old you are now; it’s never too late to start. Whenever you get a raise in pay, do not forget to increase your retirement savings. Remember also to do your research, it’s important to understand topics such as why is Medicare Advantage bad?

8. Plan for Emergencies: Even the most meticulous planner may be caught unawares by an event they did not prepare for. Taking steps to anticipate these events in advance is the best way to handle them. Create an emergency fund for things like medical bills or home repairs. Be prepared by ensuring that you always have access to liquid cash in case of an emergency. It is highly recommended that you acquire insurance coverage for your life, health, car, and your home. In the case of an unexpected medical event, healthcare coverage decreases your out-of-pocket expenses. Auto or homeowners insurance helps offset the costs associated with fire, an accident, or damage caused by a natural disaster. A term life insurance policy provides protection for your family in the event of your sudden demise.

While it is impossible to imagine every possible circumstance, it is good to know that an emergency plan exists in the event something goes wrong. If you don’t have one, SMS loans are popular in Sweden for a reason. With its fully automated application process, you have the opportunity to apply for SMS Loan wherever you are. Don’t forget that if you encounter unexpected expenses, you might have to rethink your financial plan and react to changes accordingly.

Photo, Tech Daily.

The Five Principles of Effective Money Management

Now that you know what to do to manage money on your way to a debt-free life, we must address these actions’ principles. It’s easy to talk about saving, paying off debts, and all the other tips that help lead towards a debt-free life, but how easy is it to practice? It takes a certain level of commitment and determination to manage money. It is a skill that needs to be mastered over time. Five fundamental principles guide this skill…

1. Consistency: All transactions and businesses need to be handled consistently. Routine transactions and payments should be done regularly and adhered to—especially settlements of loans and debts.

2. Timeliness: Avoid delay in payments. Make payments as and when due. A valid suggestion is that automatic payments can be set up, so the system carries out the transactions on the due dates.

3. Justification: Justify every expense. You must spend money on things that you can defend. This act avoids lavishness and promotes frugality.

4. Documentation: Keep payment receipts and transaction logs. Accountability and routine audits are most straightforward when you can backup and trace your monies’ movement.

5. Certification: For monies and accounts managed by multiple partners, you should ensure that the appropriate people approve spending before proceeding. Be responsible.

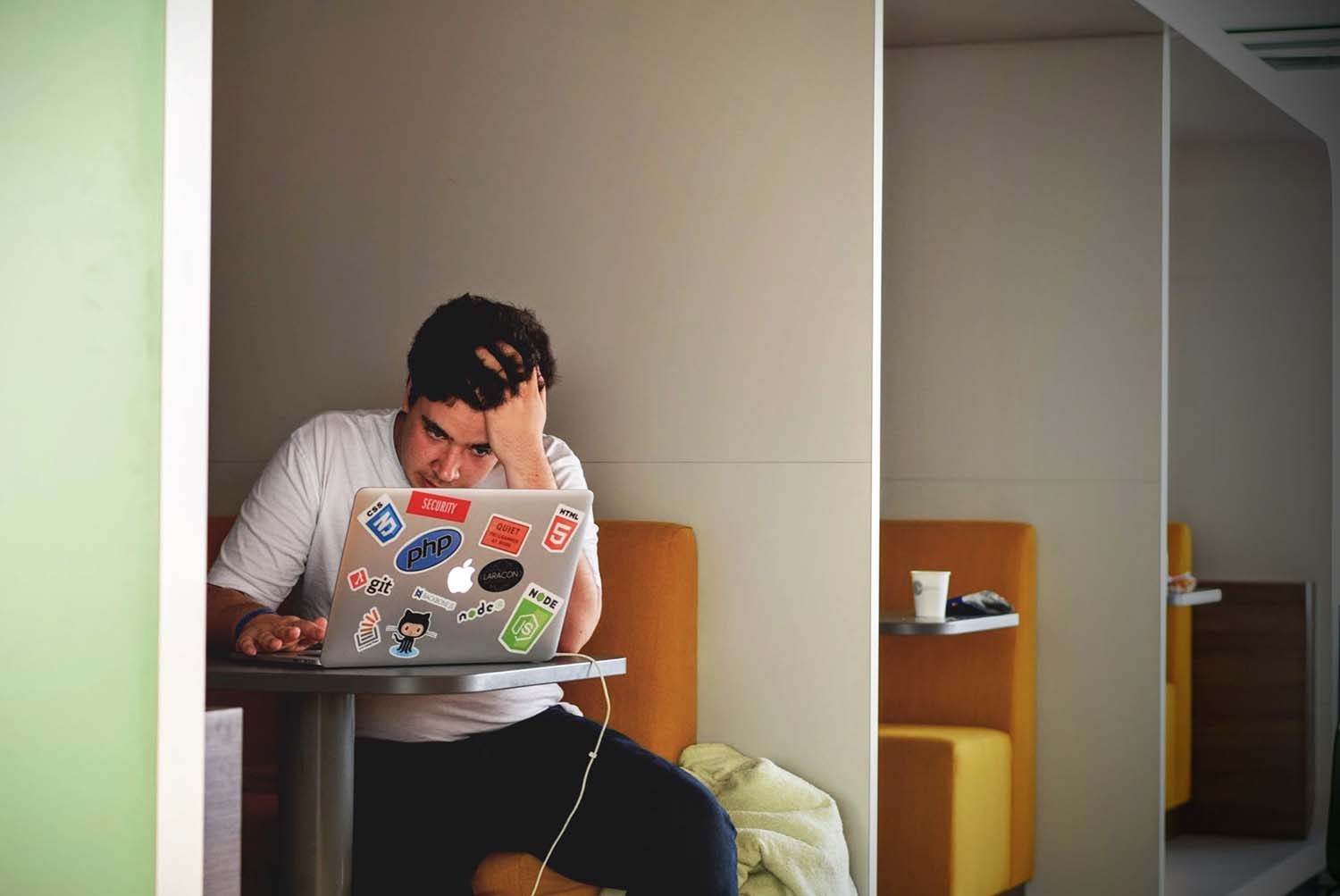

Photo, Tim Gouw.

What is Poor Money Management?

Having talked about what you need to do to manage money effectively and stay on top of your monthly expenses; let’s look at what NOT to do. What are those habits that are detrimental to your finances? The things that may not seem problematic on the surface, but deep down, eat into your pockets and keep you from ever breaking into financial freedom.

Photo, Adam Nieścioruk.

What Causes Poor Money Management? After putting into practice all the knowledge you’ve gained on money management, you still realise that your finances are still awful. Your debts seem to be stagnant; you haven’t been able to move forward with your savings goals. Everything looks out of place. Well, don’t panic. Here’s what you should know and do.

Poor money management is caused by one or more of the following factors…

Incomplete Data: Recheck that your budget contains every single item you spend money on and that these items are grouped under their appropriate categories. Do not leave anything out of the account. Here’s why, when you exclude it from the budget but still spend money on it, it’s going to be impossible to track your expenses accurately.

Absence of Discipline: Face it; you just haven’t gotten that discipline either as an individual or a company. When one person decides to stray from the budget, it is impossible to keep track of all expenses. There has to be an agreement from parties involved in financial management. The discipline has to be upheld by all members, even in families.

Flexibility: As much as you need to adhere to the budget, there also has to be room for flexibility and adjustments occasionally and routine budget review. Not adapting your budget to fit the scenario could be detrimental to your finances in unforeseen circumstances. For example, you could put in more money than budgeted to settle your credit card debt in January. This step means that you have paid part of your debt for February. Hence, you have extra money to fix somewhere else. You not knowing what category of your budget to spend this money on could affect your overall finances.

Credit: By paying interest on your credit card, you increase your monthly debt. Credit cards also undermine your money management when the interest rate is high, increasing your overall monthly debt settlement. Using credit causes poor money management and throws your budget off course. As much as you can, make use of cash and avoid credit. Also, use money monthly to help reduce your debt. When using credit is necessary, ensure you have a repayment plan sorted out before commencing.

Addiction: People who struggle with substance abuse learn that addiction is a leading cause of poor money management. Often these money issues spring up in many ways they do not envisage at the initial stage of drug or alcohol consumption. The consequences of untreated addictions ultimately affect most or all areas of an addict’s life. That leads to further damage in relationships, health, personal goals, career, and business. It’s no way to live a life, let alone a debt-free life.

Addiction being a progressive disease means that for a person to maintain an addiction, they need a constant supply of substances usually sold at high prices. Also, bear in mind that an addict’s tolerance grows as his addiction progresses. This process means that he would need an increased supply of his preferred drug to maintain the high. Over time, this lifestyle becomes exponentially very costly and eventually leads to financial difficulties.

Photo, Melissa Walker Horn.

What Should You Do?

Retrace your steps. As soon as you realise your budget is not giving you the desired results, seize its use. Go back to the beginning and reevaluate. If things still seem out of place, speak to a finance expert. In the case of an addiction, a mental health expert would have to deal with substance abuse and dependence before restoring finances.

It is important to note that practicing one single habit does not guarantee a debt-free life, the financial stability it brings, or stand as proof of good money management. You have to take into consideration the compound effect of all the characteristics and principles. And the list cannot truly be exhausted. One has to keep studying and trying to understand the principles surrounding money. The same rules apply to poor money management. Avoiding one cause does not save you from falling for the others—a combination of several positive habits guarantees improvement.