Many Americans are in some form of debt. It could be a credit card balance, mortgage, medical bills, student loans, etc. This can become a problem if you allow it to get away from you. Suppose you are having a hard time keeping up with your debt payments. A debt consolidation loan might be a good idea.

Taking another financial obligation for debt settlement might seem like a bad idea. However, consolidating all existing debts into a new loan with a lower interest rate can work if you do it correctly.

Let’s dive into the benefits and drawbacks of taking out a loan for debt repayment and alternatives you can consider.

Benefits of a Personal Loan for Consolidation

The primary purpose of a consolidation loan is to simplify your debt management plan. However, it has other benefits.

Pay less interest

A move from high-interest to low interest rates is the first factor for taking out a consolidation loan. Suppose you have several credit cards on which you pay the minimum balance. Credit card interest rates in the US come out to an average of 27.81 percent on balances. Getting a loan to cover all those balances at a fixed interest rate of 11 percent is a no-brainer. It allows you to pay less interest, provided you follow the repayment terms.

Let’s break it down. Say you have $5,000 in credit card balances. You pay the interest plus 1 percent of the balance monthly at a 27 percent interest rate. Your monthly payment is $162.50. It will take 291 months to pay off your balances and pay $10,544.65 in interest. This does not include the principal.

Segue to a 24-month personal loan for $5,000 at an interest rate of 11 percent. Your monthly payment will be $233 over 24 months. The total interest you pay will only be $592.94.

The bank or credit union might offer a lower interest rate if you have an excellent credit history, meaning you will pay even less. Therefore, credit score tracking will help you get the best deal by getting a loan when it is high.

However, remember that lenders typically have minimum loan amounts of $1,000 to $5,000 to earn higher interest. A personal loan may not be the right fit if your debt is below this range.

Avoid missing due dates

Monitoring due dates for multiple loans can be stressful for many people. Missed payments for any of them can reflect poorly in your credit report, not to mention the accompanying late payment and interest charges.

Consolidating them all into one loan eliminates that issue, as you only have to remember one. Some loan lenders even offer the facility to automatically debit your bank account or checking account for the monthly payment. You should take advantage of these benefits if you struggle to manage your obligations in a timely manner.

Improve your credit score

Applying for a personal loan might result in a hard inquiry at credit bureaus, which can initially affect your credit. However, taking out a personal loan could boost your credit in two ways in the long term. For one, it increases your account type mix, which is good for your FICO or credit score. For another, consolidating debt can lower your credit utilisation to below 30 percent, which can also help increase your credit score.

Drawbacks of a Personal Loan For Consolidation

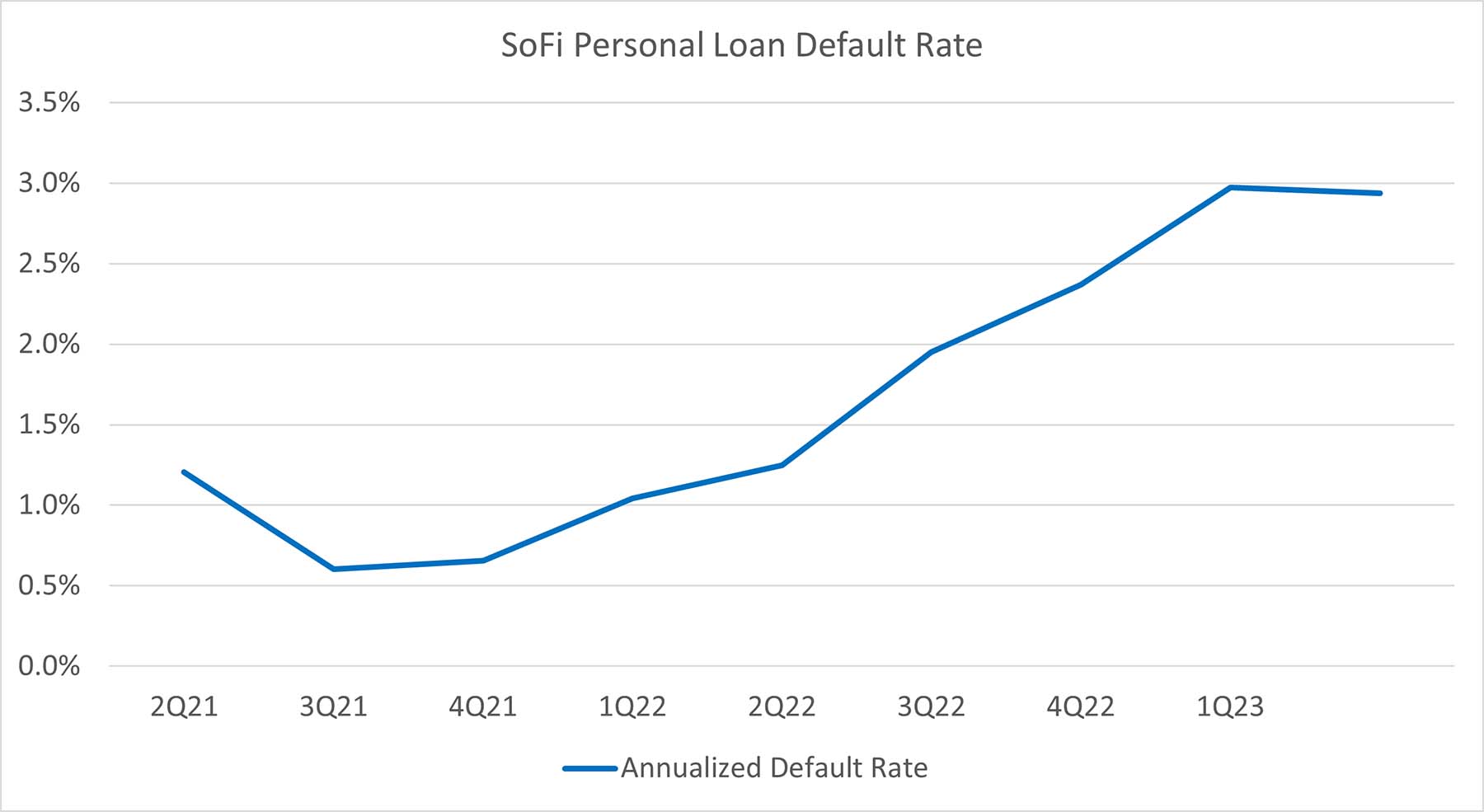

Source: SoFi.

You employ debt refinancing strategies when you take out a loan to pay another debt. However, you should know the financial risks of taking out a loan for debt repayment.

Pay more monthly

A personal loan for consolidating debt may come with a lower interest rate. However, it may require you to pay more monthly, which can cut a larger slice of your budget than you can afford. Remember that a fixed-rate loan locks you into a set monthly payment for a specific period of time. The sample scenario shows that you have lower monthly payments for the credit card than a consolidation loan.

You need to consider whether you can afford to pay the loan off. Work with the lender to fully understand your obligations before getting a loan.

Deal with fees

You might not be aware that taking out a personal or consolidation loan may involve different fees affecting your savings. Some lenders may impose a one-time origination fee to process the loan, typically between one and five percent of the loan amount. It may be an upfront payment or included in the loan. In the latter case, you also pay interest on that amount.

You should also ask about other fees, like a prepayment penalty for repaying your loan earlier than the term. In most cases, it is three percent of the remaining balance.

Choose a lender or loan facility that does not charge additional fees. Sometimes, the lender will waive these fees if your credit score is good.

Acquire more debt

You should only take out a loan to pay another debt if you want to be debt-free eventually. Suppose you start using your credit card again after paying it off and not paying the entire balance. That is going to plunge you into deeper trouble.

Before considering taking out a loan, consider your debt-to-income ratio. Based on your current income, ensure you can comfortably pay the monthly on time and in full. You should still be able to pay for other obligations without acquiring more debt, like using credit cards.

Other Options

A personal or consolidation loan is a good idea in some circumstances, but not all. Consider the following options to manage your debt.

Balance transfer credit card balances

When dealing exclusively with credit card debt, a balance transfer to a card with 0 percent introductory APR is an alternative to a consolidation loan . The APR is the annual percentage rate the card issuer imposes for balances. However, some cards will suspend interest charges for qualified purchases and balance transfers for a specific period, typically 12 to 24 months. This means you can pay off your balance transfers without paying interest within the introductory period. Some impose a transfer fee, but that’s it.

Of course, you must qualify for the promotion, which usually means you must have a good credit score. The strategy is also only effective if you can do a balance transfer of all cards to one card. You must also pay the monthly statement every time and before the end of the introductory period.

Home equity loan

Suppose you have equity in your home. You can use that equity to get a home equity loan or line of credit. These may have a lower interest rate than a consolidation loan. However, that is not always the case. As of this writing, the average interest rate for home equity loans is 9.07 percent higher than some personal loan rates. Ensure you compare rates before you commit your home and risk losing it in a home equity loan you cannot repay.

Retirement accounts

Suppose you have a 401(k) plan. You can access up to half of the value of the assets or $50,000, whichever is less, tax-free. You can use the loan funds to pay debts but must repay them within a set period.

Some call it a 401(k) loan, but it is not technically a loan as no lender is involved. Any interest you pay goes back to your 401(k) account, so you are essentially paying yourself. Finally, you can get a 401(k) loan quickly, and it does not involve a credit inquiry. Some 401(k)s also offer the facility to pay the money back through payroll deductions. It seems the ideal solution for debt repayment.

However, not all employers allow 401(k) loans, or you may not meet eligibility requirements. Furthermore, some 401(k)s disallow contributions for an account with an outstanding loan. That prevents you from growing your 401(k) for a substantial period. Additionally, withdrawing existing funds may hinder your portfolio from performing optimally.

Suppose you have a substantial individual retirement account (IRA). You cannot access the funds in a loan-like arrangement like a 401(k). However, the Internal Revenue Agency (IRA) allows rollovers under the 60-day rule. You can withdraw from the account with no penalties if you put it back within 60 days, once every 12 months. That is an excellent alternative to a consolidation loan if you can return it on time.

Takeaway

Your circumstances dictate whether you should take out a loan to pay another debt. The goal is to get out of debt, not allow it to snowball. Generally, you must be able to pay off the loan in full without getting into more debt.

Understanding the various loan terms can help you make an informed decision. Compare different personal loan offers to find the best one for your needs and personal finances. You can also get credit counselling to gain professional insights into your situation.